Don’t ignore how increases in Customer Lifetime Value can impact Customer Acquisition Costs and overall profitability. Your bottom line will thank you.

Why You Should Care about Customer Lifetime Value

As a digital marketing expert for e-commerce websites, my clients are constantly struggling to lower their customer acquisition costs. One of the best ways to lower acquisition costs is to increase the Customer Lifetime Value or (CLV) of your buyers.

Put simply, CLV is the amount of money a customer will spend on your website throughout their lifetime. So, in order to increase your CLV, you need to focus on retaining your existing customers and encouraging them to make repeat purchases.

Be sure to scroll down to understand the relationship between Customer Acquisition Costs (CAC) and CLV. I’ve also included a cheat sheet how to calculate them and even a ratio that shows how one affects the other.

Authors note: My 2 favorites are actually farther down on the list at #8 and #9.

10 Ways to Increase Customer Lifetime Value

1. Loyalty Programs – Reward your customers for their loyalty by offering them exclusive discounts, special offers, and other benefits. Recent studies have shown that offering a Cash Back incentive is preferred by customers and they only redeem it 50% of the time! A win-win if I’ve ever seen one!

Pros: It can increase customer retention and attract new customers.

Cons: It can be expensive to set up and manage.

2. Personalized Recommendations – Use data analysis to suggest products that customers are likely to buy based on their past purchases. This is different than cross-selling and upselling which is covered next.

Pros: It can increase customer satisfaction and loyalty.

Cons: It requires a lot of data and analysis to be effective. It also requires an app or 3rd party software which has additional costs.

3. Cross-selling and Upselling – Suggest related products or upgrade options during the buyer’s journey. This should be done on the product page, cart, checkout, and even order confirmation pages.

Pros: It can increase the average order value and encourage customers to buy more.

Cons: It can be seen as pushy if not done correctly.

4. Customer Reviews and Ratings – Encourage customers to leave reviews and ratings of your products.

Pros: It can increase customer trust and attract new customers.

Cons: Negative reviews can have a negative impact on your business and if you hide negative reviews it looks unnatural and you lose trust.

5. Email Marketing – Use email to keep your customers informed about new products, special offers, and other promotions.

Pros: It is one of the cheapest sources of sales since you’ve already acquired these customers and can be an effective way to keep your brand top of mind over time.

Cons: It can be easy to overdo it and annoy customers. Make sure to offer SMS as an option.

6. Social Media Marketing – Use social media to engage with your customers and promote your brand.

Pros: It can be an effective way to reach a large audience and is very low cost. Sometimes you go viral and others are doing your marketing for you for free!

Cons: It can be time-consuming to manage and may not be as effective for some businesses.

7. Abandoned Cart & Browse Abandon Recovery – Send follow-up emails to customers who have abandoned their shopping carts. If you can pixel visitors who have viewed products and not yet added to the cart, targeting them with incentivized emails is another great option.

Pros: It can increase conversion rates and revenue.

Cons: It can be seen as intrusive if not done correctly.

8. Customer Service – Offer excellent customer service to keep customers happy and satisfied. This is so overlooked but has direct impacts on if/when an existing customer comes back to buy again. Studies show that even buyers who have negative experiences come back to buy at larger CLV values if that person gets great customer service and resolution of their complaint.

Pros: It can increase customer loyalty and retention.

Cons: It can be expensive to provide high-quality customer service.

9. Referral Programs – Reward customers for referring new customers to your website. Let your customers do your marketing for you! What is the acquisition cost for these sales? ZERO!.

Pros: It can attract new customers and increase brand awareness.

Cons: It can be difficult to track and manage.

10. Subscription Services – Offer subscription services for products that customers purchase regularly. Many buyers set it and forget it when it comes to consumable products. So give them the option to have their purchase delivered to their door on a regular basis.

Pros: It can provide a reliable source of revenue and increase customer loyalty. It also leads to higher company valuations if the owner is looking to cash out or raise money down the road.

Cons: Don’t try to shoe horn a subscription plan into place where it doesn’t make sense.

While there are many other tactics to increase customer lifetime value and drive down customer acquisition costs, these are some of the most effective ones.

It’s important to remember that different tactics work for different businesses, so experiment and find what works best for you.

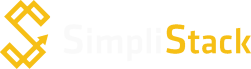

What Impact CLV Has to Customer Acquisition Costs

Increasing customer lifetime value (CLV) will have a strong impact on customer acquisition costs (CAC).

Here is how:

- Improved retention rates: When customers have a high CLV, it means they are likely to stay with a brand for a longer time. This reduces the need for brands to constantly acquire new customers, which can be an expensive process. By improving retention rates, brands can reduce their CAC and allocate more resources towards other areas of marketing.

- Increased referral rates: Happy customers are more likely to refer their friends and family, which can help to reduce CAC. By increasing CLV, you can create more loyal customers who are more likely to refer other people to your store.

- Higher customer lifetime spend: When customers have a high CLV, they are likely to spend more money throughout their life. This means that the initial cost of acquiring each customer is spread out over a larger period of time, reducing the overall CAC for that customer.

- Improved customer experience: This one is a bit more esoteric. But companies that focus on increasing CLV often prioritize a better customer experience. This results in higher customer satisfaction, which helps to reduce churn for subscription companies and increases peer to peer referral rates.

Bonus Section – Calculating CLV, CAC and Ratios

Let’s make sure you know how each formula is calculated. Then we’ll take a look at the ratio between them and how that can be used for actionable insights:

- CLV: The total revenue a customer will generate over their entire lifetime with your brand. There are variations, but the simplest formula is:CLV = (Average purchase value) x (Number of purchases per year) x (Customer lifespan)

This can be further refined by factoring in retention rates, customer acquisition costs, and discount rates.

- CAC: The total cost of acquiring a new customer. Many companies simply include marketing and advertising costs for their paid channels. But some companies include sales team salaries and other expenses associated with acquiring new customers. The simplest form of this calculation is:CAC = (Total marketing and sales costs) / (Number of new customers acquired)

- CLV:CAC: The ratio of CLV to CAC is a measure of the effectiveness of a your marketing and acquisition strategies. Data shows that a ratio of 3:1 or higher means your brand is likely to be profitable, while a ratio of less than 1:1 means your brand is spending too much to acquire new customers.CLV:CAC ratio = CLV / CAC

You get the most value out of these metrics by tracking them over time. This takes away bias from other industries where the numbers aren’t representative of yours.

Next Steps

If you want to flush out any of these concepts, feel free to contact us for a free consultation.